Are you ready to transform your financial situation without sacrificing your lifestyle?

In this listicle, we will unveil 15 ingenious budgeting hacks that can help you save money and pave the way to financial freedom.

From simple tweaks to your spending habits to strategic savings techniques, each tip is designed to empower you on your journey toward a more secure financial future. Get ready to redefine your relationship with money and discover how these hacks can change your life!

Contents

- 1. The 50/30/20 Rule

- 2. Automate Your Savings

- 3. Create a No-Spend Challenge

- 4. Use Cash Envelopes

- 5. Track Your Expenses

- 6. Meal Planning and Prep

- 7. Negotiate Bills

- 8. Buy in Bulk

- 9. Set Financial Goals

- 10. Use Cashback Apps

- 11. Review Subscriptions

- 12. DIY Gifts

- 13. Shop Off-Season

- 14. Utilize Public Resources

- 15. Review and Adjust Regularly

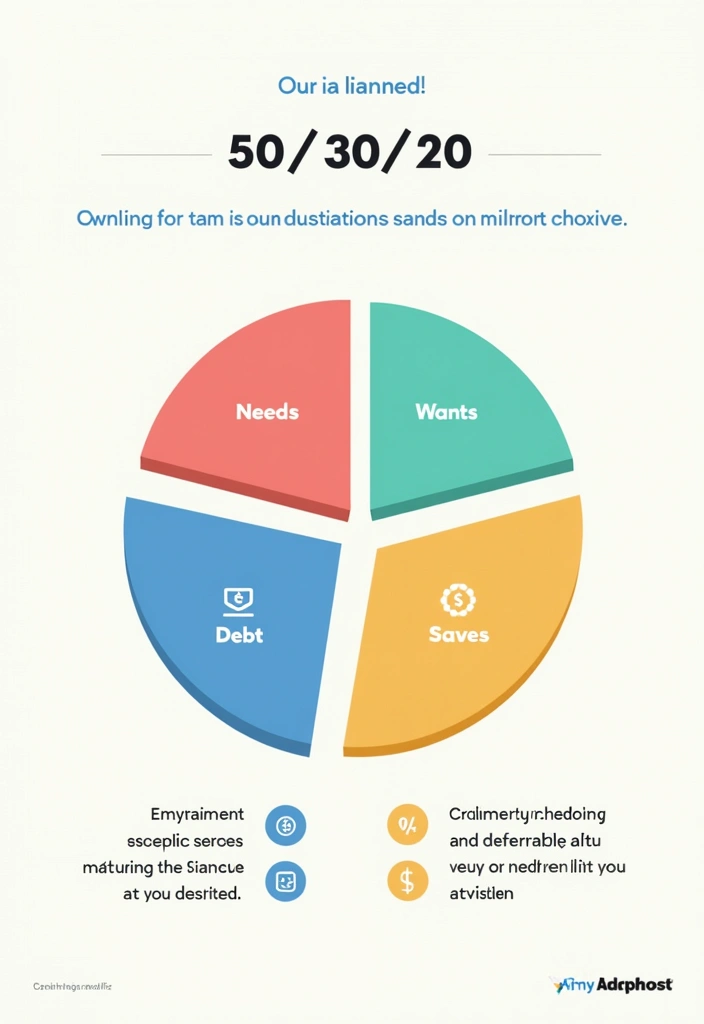

1. The 50/30/20 Rule

A time-tested budgeting strategy known as the 50/30/20 rule can significantly enhance your financial management skills.

This approach encourages you to divide your income into three distinct categories: allocate 50% for essential needs, 30% for discretionary wants, and 20% towards savings and debt repayment.

By breaking down your expenses in this way, you can easily pinpoint areas where you may be overspending and make necessary adjustments. To delve deeper into effective budgeting techniques, consider exploring budgeting books that provide valuable insights.

Additionally, using pie chart stickers can visually represent your budget, making it more engaging and easier to follow.

For a comprehensive approach to financial planning, don’t forget to check out financial planning guides that can help you maintain a balanced lifestyle while ensuring you save for the future.

2. Automate Your Savings

One of the most effective strategies for saving money effortlessly is to automate your savings.

By setting up an automatic transfer from your checking account to your savings account each month right after payday, you can ensure that your savings grow without any extra effort on your part. This way, you won’t even miss the money, and your financial cushion will increase regularly. Consider utilizing savings app subscriptions that can help you manage this process seamlessly.

Additionally, you might explore automatic transfer bank accounts that can facilitate these transfers with ease. For a more tangible approach, a classic piggy bank can serve as a fun and motivating way to save physical cash.

Lastly, to keep track of your progress, consider using financial goal trackers that can help you stay disciplined and focused on your savings objectives. By integrating these tools, you can build your savings gradually while also enhancing your spending habits.

3. Create a No-Spend Challenge

Challenge yourself to embark on a no-spend month, a powerful way to reset your spending habits and identify unnecessary expenses that can add up over time.

During this period, you’ll focus solely on essential expenditures such as groceries, utility bills, and gas. To enhance this experience, consider using a no-spend challenge journal to track your progress and reflect on your journey. This hack not only promotes mindfulness about your spending patterns but also reveals the significant savings that come from cutting out non-essential purchases.

Additionally, you might find it motivating to use budgeting apps to help you stay organized and accountable throughout the month.

To make this challenge even more enjoyable, consider involving friends or family, transforming a financial task into a fun social event. You can decorate your space with motivational posters that inspire you to stay on track. If you want to dive deeper into financial strategy, look into group financial planning workshops to expand your knowledge and share experiences with others.

4. Use Cash Envelopes

Cash envelopes provide a hands-on approach to budget management and can significantly reduce overspending.

By designating specific amounts of cash for various categories such as groceries, entertainment, and dining out, you can place the cash into cash envelope budgeting systems that are both functional and stylish.

Each envelope is labeled for clarity, and once the cash is depleted, you simply cannot spend more in that category for the month. This tangible limitation keeps you focused on your budget and promotes smarter spending habits.

To enhance your budgeting experience, consider using decorative envelope sets that make managing your cash more enjoyable. You can also add some flair with budgeting stickers to personalize your envelopes further.

Additionally, investing in cash organizers can help keep your budgeting system neat and organized, ensuring you stay on track with your financial goals.

5. Track Your Expenses

Keeping a detailed record of all your expenses is crucial for understanding where your money is going. By using budgeting apps like this budgeting app, or opting for expense tracking software, you can log every purchase easily. This practice allows you to identify spending patterns and find areas where you can cut back.

Visualizing your expenses with tools such as financial calculators enhances your ability to make informed decisions and adjustments to your budget. This hack not only promotes accountability and awareness but also leads to the development of better financial habits, setting you on a path toward financial stability and success.

6. Meal Planning and Prep

Save money and improve your health by incorporating meal planning and prep into your routine.

Start by crafting a weekly menu that takes advantage of sales at your local grocery store. To help keep you on track and avoid impulse purchases, use grocery shopping lists to organize your ingredients. Meal prepping not only minimizes food waste but also saves you valuable time during busy weekdays, preventing the temptation of costly takeout.

To stay organized, consider using meal planning notepads that allow you to jot down your meals for the week. For added inspiration, check out some healthy recipe books that align with your dietary goals. Lastly, invest in meal prep containers to keep your meals fresh and ready to go, promoting both your financial and physical well-being.

7. Negotiate Bills

Don’t hesitate to negotiate your bills! This often-overlooked budgeting hack can lead to substantial savings that make a real difference in your financial health.

Reach out to your service providers—whether it’s for internet, cable, or insurance—and inquire about lowering your rates or any promotional deals they might have available. Many companies would prefer to keep you as a customer rather than losing you to a competitor.

To enhance your negotiation skills, consider reading a few negotiation skills books that can equip you with effective strategies. Additionally, using a phone bill calculator can help you understand your current expenses and make a strong case for your negotiations. Lastly, managing your overall finances becomes easier with budgeting apps that track your spending and help you stay organized. This simple act of advocacy can help you save hundreds of dollars each year!

8. Buy in Bulk

Buying in bulk can lead to significant savings, particularly on items you frequently use. By investing in bulk storage containers, you can keep your purchases organized and ensure that you have enough supplies on hand.

Consider stocking up on non-perishable goods, toiletries, or cleaning supplies in larger quantities to take advantage of lower unit prices. To keep your shopping organized and avoid impulse buys, using grocery shopping lists can be a game changer.

Additionally, a membership for warehouse clubs can provide access to even more bulk savings, making it easier to find deals on your favorite products. Remember, though, that it’s essential to ensure you can actually use these items before they expire, as buying unnecessary bulk can lead to waste. This hack is not just about saving money; it’s also about smart consumption. Explore options like discount bulk food subscriptions to make the most of your bulk buying strategy.

9. Set Financial Goals

Setting clear financial goals can truly transform your budgeting journey. Whether you’re aiming to save for a dream vacation, eliminate debt, or establish a solid emergency fund, having specific targets can significantly boost your motivation to adhere to your budget.

To keep your goals at the forefront of your mind, consider creating a vision board using a vision board kit. This can help you visualize your aspirations and maintain your focus on achieving financial freedom.

Additionally, diving into motivational books on finance can provide you with valuable insights and inspiration to stay committed to your financial objectives.

Lastly, participating in financial planning workshops can equip you with the skills and knowledge necessary to create and execute a successful budgeting strategy. Remember, each small milestone achieved brings you closer to significant accomplishments!

10. Use Cashback Apps

Take advantage of cashback apps to earn money back on your everyday purchases. By using these apps, you can receive a percentage of your spending back when you shop at participating retailers, making it feel like you’re receiving a little bonus for buying the essentials you need.

To enhance your budgeting journey, consider investing in cashback app subscriptions that can help you track and maximize your savings.

Additionally, pairing these apps with insightful budgeting books can provide you with strategies to optimize your finances.

Don’t forget to gear up with essential smartphone accessories that enhance the functionality of your cashback apps, turning your regular shopping into a rewarding experience!

11. Review Subscriptions

Regularly assessing your subscriptions can reveal unexpected expenses that may be straining your budget.

By taking the time to evaluate which services you actively use and which ones you can eliminate, you can make significant savings. Consider utilizing a subscription management app to help track and manage your subscriptions effectively. This can streamline the process and highlight those services that are no longer necessary.

Additionally, if you prefer a more hands-on approach, budget-friendly budgeting spreadsheets can help you organize your finances and identify areas to cut back. For those who enjoy journaling, a financial planning journal can be a great tool to reflect on your spending habits and set future financial goals.

Finally, if you’re unsure how to proceed with canceling services, consider using cancellation guides that provide step-by-step instructions. By cutting out unused services, you can save a surprising amount each month and redirect those funds toward achieving your financial aspirations.

12. DIY Gifts

Save money on gifts by creating your own DIY presents that are not only thoughtful but also deeply personal.

Handmade gifts like delicious baked goods, custom photo albums made with photo album materials, or unique craft projects using DIY craft kits not only help you save money but also demonstrate how much you care about the recipient.

These creative endeavors not only enhance your artistic skills but also allow you to make special occasions memorable without straining your budget. Don’t forget to wrap your creations beautifully using gift wrapping essentials to add that final touch of love!

13. Shop Off-Season

Shopping off-season for clothing, holiday decorations, or outdoor gear can lead to substantial savings. Retailers often mark down items when they’re out of season, allowing you to snag great deals if you plan your purchases strategically.

To enhance your shopping experience, consider utilizing seasonal shopping guides that can help you identify the best times to buy specific items. Additionally, using discount alert apps can ensure you never miss a sale, providing notifications for markdowns on the products you want.

Once you’ve made your purchases, keep your wardrobe organized with clothing organization tools that help you manage your off-season items effectively. If you find yourself shopping online frequently, consider investing in online shopping memberships that offer exclusive discounts and free shipping, further maximizing your budget while you enjoy shopping year-round!

14. Utilize Public Resources

Take advantage of local public resources that can significantly reduce your expenses. Libraries are treasure troves of knowledge and entertainment, and you can enhance your experience with a library card holder to keep your borrowed books organized.

Community centers and parks frequently provide free classes, events, and activities that enrich your life at no cost. Consider enrolling in community class subscriptions, which you can find here, to learn new skills and connect with others in your area.

Additionally, if you’re looking to stay active, many parks offer free fitness programs, and having the right fitness gear can enhance your experience. Engaging with these resources not only saves you money but also fosters a sense of community.

15. Review and Adjust Regularly

Regularly reviewing and adjusting your budget is essential for maintaining financial discipline and achieving your goals.

Consider scheduling monthly check-ins to assess your spending habits—this is a great opportunity to reflect on areas where you may have overspent or discover new opportunities for savings.

Utilizing tools like a budgeting journal can help you track your progress and jot down insights during these reviews. Additionally, participating in financial planning workshops can provide valuable guidance and strategies to refine your budget further.

Finally, incorporating an expense tracking app can streamline the process, allowing you to adjust your budget in real-time based on your evolving needs. This flexible approach ensures that your budgeting remains relevant and effective, keeping you firmly on the path to financial freedom.

Conclusion

Implementing these 15 budgeting hacks can significantly enhance your financial well-being and help you achieve your goals.

Remember, the journey to financial freedom is a marathon, not a sprint—consistency is key.

Share your favorite budgeting hacks in the comments below and inspire others on their path to financial success!

Note: We aim to provide accurate product links, but some may occasionally expire or become unavailable. If this happens, please search directly on Amazon for the product or a suitable alternative.

This post contains Amazon affiliate links, meaning I may earn a small commission if you purchase through my links, at no extra cost to you.

3 thoughts on “15 Budgeting Hacks That’ll Change Your Life (You Won’t Believe #9!)”